Bybit surpasses Coinbase to become second largest crypto exchange by volume – Kaiko

Bybit strengthens position in derivatives market amid Binance’s regulatory hurdles.

Quick Take

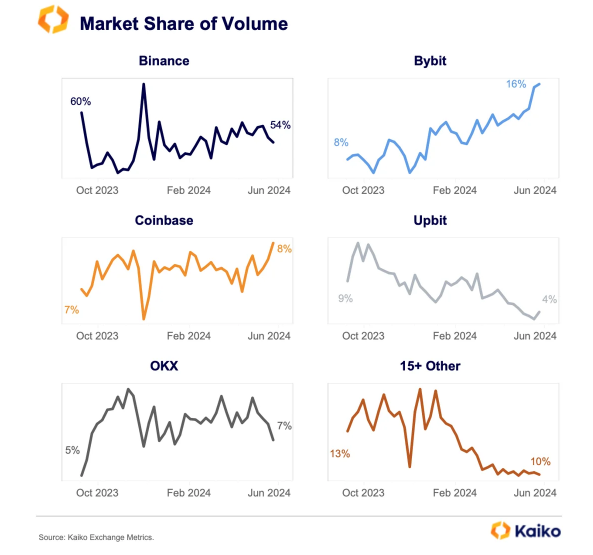

In recent months, Bybit crypto exchange has surged to become the second-largest exchange by volume, surpassing Coinbase, according to data from Kaiko. Since October 2023, Bybit has doubled its market share from 8% to 16%, while Binance, although still the leader, has seen its share drop from 60% to 54%. Kaiko attributes an increase in market volume to the January launch of spot bitcoin ETFs, significantly boosting overall crypto trading volumes.

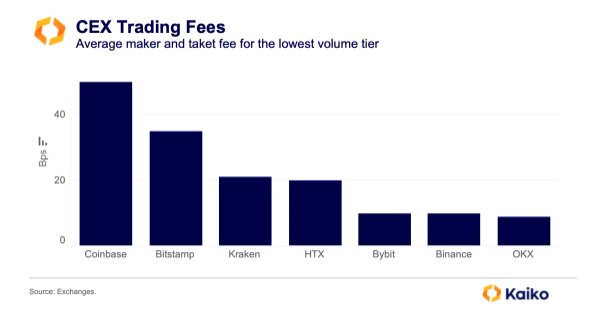

Kaiko’s data shows that Bybit’s competitive fee structure is highlighted as a key factor in its market share gains. With one of the lowest fee scales in the industry, Bybit has successfully drawn traders away from its competitors. Meanwhile, other exchanges like OKX and Binance offer similar low fees and zero-fee promotions.

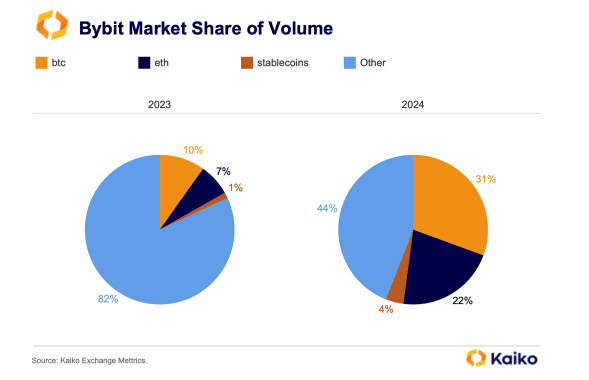

Bybit has shown remarkable growth in the spot market for Bitcoin and Ethereum. Bitcoin’s market share on Bybit jumped from 10% to 31%, while Ethereum rose from 7% to 22% from 2023 to 2024, according to Kaiko data.

Kaiko notes that Binance has observed a decline in Bitcoin and Ethereum spot volumes, which now stand at 43%, down from 59% a year ago, although it continues to dominate in altcoin volumes.

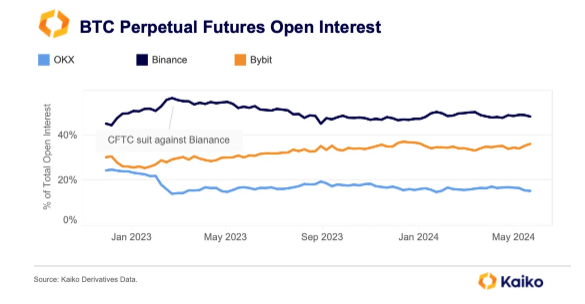

Kaiko also shows that in the derivatives market, Bybit has solidified its position as the second largest, trailing only behind Binance. It particularly benefitted from the latter’s regulatory challenges earlier in 2023. However, during the same period, OKX experienced a significant reduction in its market share, which declined from 25% to 15%.