Bitcoin Bullish Signal: Inflows To HODLer Wallets Hit ATH

On-chain data shows the Bitcoin inflows going towards “accumulation wallets” have hit a new all-time high, a sign that could be bullish for the asset.

Bitcoin HODLer Inflows Recently Hit 25,300 BTC

As explained in a post on X by Ki Young Ju, the founder and CEO of the on-chain analytics firm CryptoQuant, Bitcoin inflows toward accumulation wallets have hit a new ATH.

Now, what exactly are accumulation addresses? According to Ju, the wallets that satisfy the following five conditions are counted among these accumulation addresses.

The first condition is that the address must have no outgoing transaction. This naturally means that an accumulation address would have only witnessed incoming transfers.

Second, the balance of the address should be at least 10 BTC. At the current cryptocurrency exchange rate, this lower limit is equivalent to around $512,000.

The third rule is that the address shouldn’t be part of centralized exchanges or miners. These two are special entities on the network for obvious reasons, so they are excluded and limited to “normal” investors.

The fourth condition is that the address should have received more than two incoming transfers in its life, and the fifth and final condition is that the most recent of these transfers should have occurred within the past seven years.

Wallets that have been dormant for more than seven years are usually permanently lost to time due to missing keys, so they don’t exactly count as “HODLers” like the other accumulation addresses would.

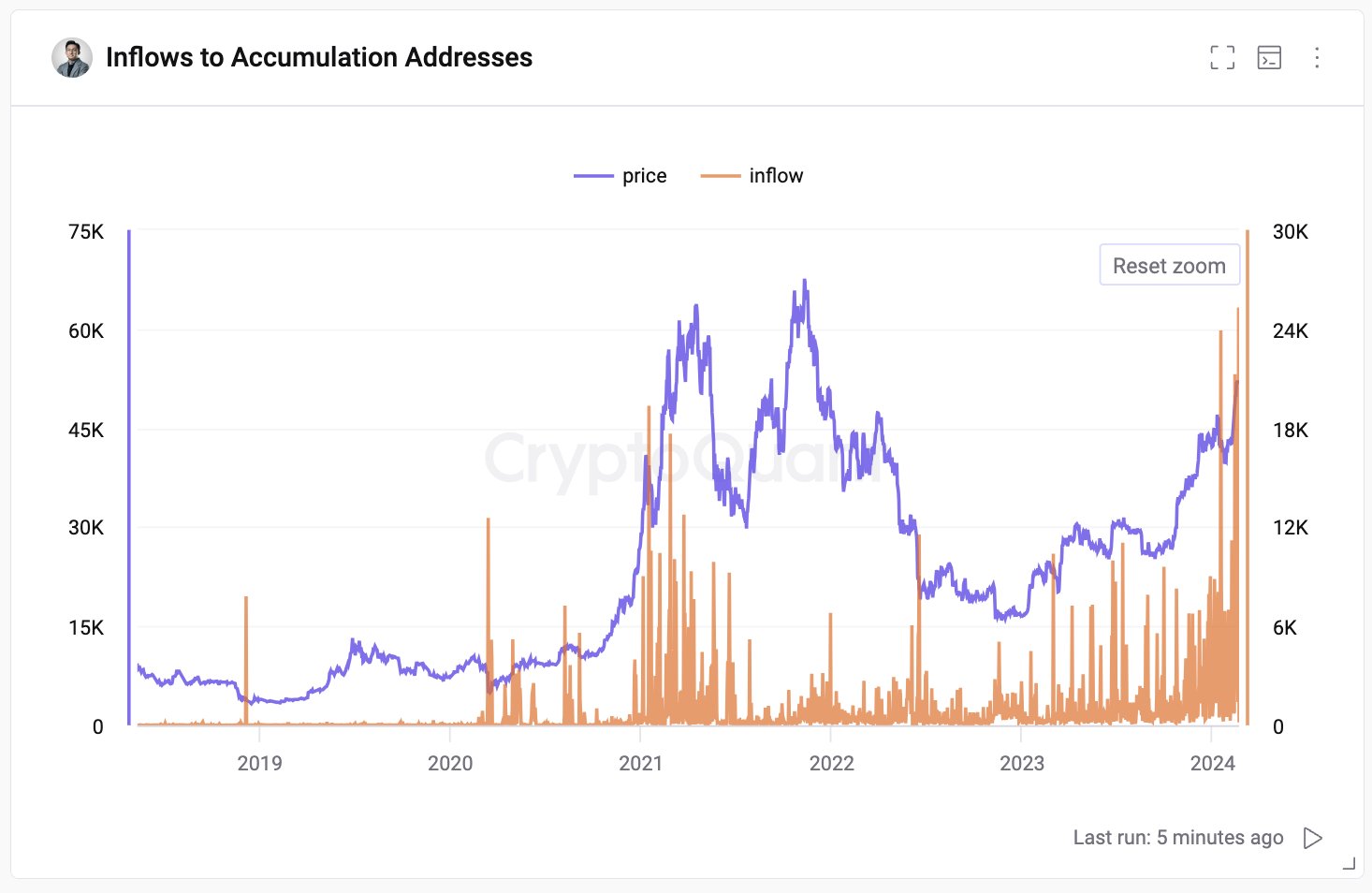

Now, here is the chart shared by the CryptoQuant founder that displays the Bitcoin inflow data for these accumulation addresses over the last few years:

The value of the metric seems to have been quite high in recent days | Source: @ki_young_ju on X

Here, “inflow” is naturally a measure of the total amount of Bitcoin entering into a wallet that fits the criteria of an accumulation address. From the graph, it’s visible that the indicator has registered a large spike just recently.

During this latest spike, the indicator, in fact, set a new record as a whopping 25,300 BTC (almost $1.3 billion) flowed into these wallets. This naturally suggests that these HODLers have been buying big recently.

A close inspection of the chart reveals that this latest spike isn’t the only large spike the indicator has observed this year, as it would appear that the metric has been registering large values since the spot ETFs were approved last month.

The previous ATH of the metric coincided right with the spot ETF launch. Thus, these indicator spikes may be partly because of institutional buying related to the ETFs.

Whatever the case, the accumulation addresses expanding their holdings, which is a positive sign, as these HODLers, who have never sold before, might continue to hold strong shortly, essentially locking these coins out of the available supply.

BTC Price

Bitcoin has struggled in the past day as its price has retraced towards the $51,100 mark.

Looks like the price of the coin has registered some decline in the last 24 hours | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, CryptoQuant.com, chart from TradingView.com