Next Batch Of Locked Solana Tokens To Be Sold By FTX Estate

The estate of the bankrupt crypto exchange FTX is preparing for another significant disposition of assets, this time involving locked Solana (SOL) tokens. Unlike prior transactions, this batch of Solana tokens will be sold through an auction process, a departure from the fixed-price sales previously conducted.

According to Mike Cagney, CEO of Figure Markets, a decentralized financial services firm, the estate will reveal the exact details of the auction today. The decision to opt for an auction rather than a fixed-price sale reflects a strategic pivot designed to potentially maximize returns for the estate’s creditors.

How Much Are The Solana Tokens Selling For This Time?

The last transaction involving Solana tokens by the FTX estate brought in $1.9 billion, with the tokens priced at approximately $64 each, in stark contrast to Solana’s current market value of around $150, representing a 67% discount to its market value at the time. As FTX disclosed in the summer of 2023, the bankrupt crypto exchange held $1.2 billion in Solana as at August 31, 2023. SOL was at $20 at the time.

Figure Markets, led by Cagney, is organizing a Special Purpose Vehicle (SPV) to allow a broader range of investors to participate in the auction. This SPV will be open to non-US investors and accredited US investors, aiming to consolidate and amplify bidding power.

Cagney’s announcement on X (formerly Twitter) serves both as a call to action and an invitation: “Just got confirmation that the next round of locked Solana coins from the FTX estate will be an auction, with exact details coming Monday. If you want in, join us.”

Cagney added in another post on X, “Ok – are you an FTX creditor upset about the SOL sales? Or you aren’t a creditor, but still think the last sales went way too cheap? Well, now you can do something about it.” This initiative not only opens up financial opportunities for investors but also provides a platform for affected parties to influence the outcome of the asset liquidation process actively.

Related Reading: Solana Lender Drama Deepens: $250 Million Outflow After Founder Quits

The locked Solana tokens represent a significant portion of FTX’s asset holdings at the time of its collapse and have been a focal point for buyers willing to speculate on the future market movements of these assets. The nature of these tokens, being locked, means they cannot be sold until a specified future date, adding a layer of risk and potential reward that appears to have attracted strong investor interest.

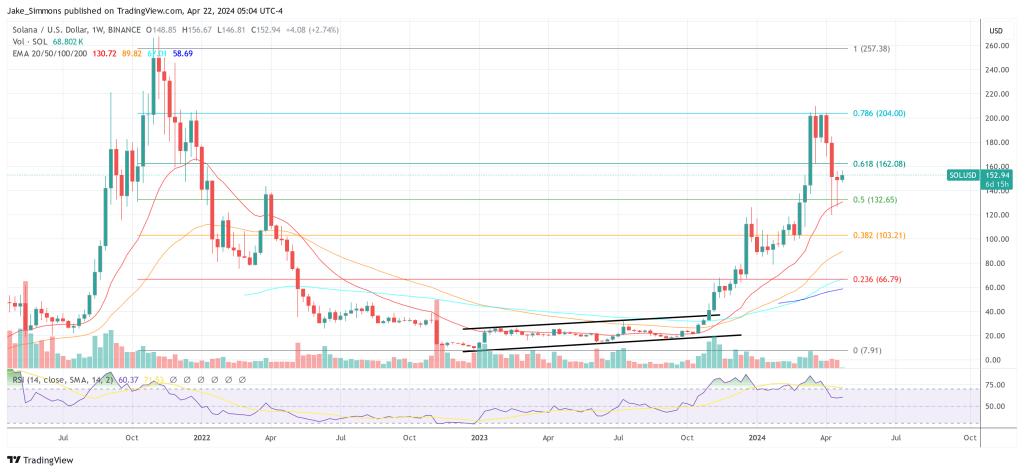

At press time, the Solana share price was -27% below its high for the year of $210. SOL was trading at $ 152.94 and is now heading for the crucial resistance of the 0.618 Fibonacci retracement level at $162.

Featured image from X @solana, chart from TradingView.com