Uniswap Governance Proposal Sparks 60% Price Surge

The Uniswap Foundation has unveiled a comprehensive proposal to revitalize Uniswap’s governance structure. This initiative incentivizes active and thoughtful participation by rewarding UNI token holders for delegating and staking their tokens.

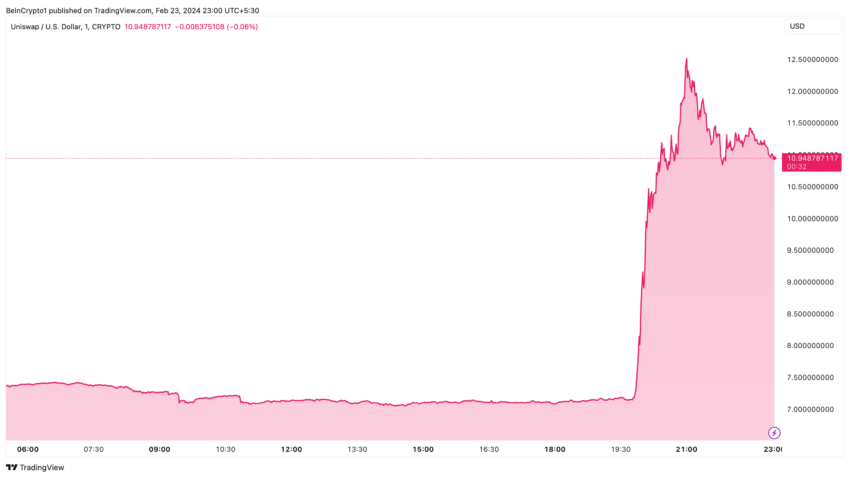

This announcement has ignited a fervent response from the cryptocurrency market, propelling the price of UNI tokens by an astonishing 60%.

Uniswap’s New Governance Proposal

At the heart of this proposal is a strategic enhancement to the protocol’s fee mechanism. Uniswap aims to foster a more engaged and responsible delegate community by aligning rewards with active governance participation. This move a bold step toward ensuring the protocol’s long-term sustainability and growth.

“This upgrade would reward UNI holders who have staked and delegated their tokens… Decentralized, resilient, and engaged governance is imperative to the long-term health and success of the Protocol. We believe this upgrade will strengthen and invigorate Uniswap governance,” Uniswap said.

Indeed, the Foundation’s vision for Uniswap is about crafting a governance model that can adapt and thrive over decades, securing its position as the backbone of internet liquidity. This involves a deep commitment to improving the delegate experience. This was demonstrated by initiatives like the Delegate Race, the Bridge Report, and the upcoming GovSwap gatherings.

These efforts have already begun to pay dividends, with a noticeable uptick in delegate activity and community-driven governance initiatives. Still, the Foundation acknowledges the ongoing challenges of free-riding and apathy, highlighting the need for this proposal’s innovative approach to reinvigorate governance participation.

This proposal’s technical backbone rests on deploying two new smart contracts designed to integrate with Uniswap’s existing on-chain ecosystem seamlessly. These contracts will enable the permissionless collection of protocol fees and their distribution to engaged UNI token holders. This mechanism ensures that governance remains firmly in control of key protocol parameters while incentivizing meaningful participation.

The schedule for the proposal is set for a Snapshot vote on March 1, followed by an on-chain vote on March 8. Just one week before the public vote, the UNI price has seen a significant uptick. Indeed, it has soared by over 60% from $7.36 to reach an intraday peak of $12.53.

“UNI is up by [60%] on the proposal to introduce a fee to reward UNI holders who stake and delegate their tokens. It’s not the first time the proposal has been suggested, but this time it’s Erin Koen, who is a Gov Lead at Uniswap Foundation,” DeFi researcher Ignas said.

Read more: Uniswap (UNI) Price Prediction 2023 / 2025 / 2030

The Foundation’s proposal is a testament to the collaborative effort of the Uniswap community. It has the contributions from leading entities like Scopelift, Gauntlet, and Avantgarde Finance. It also honors the innovative spirit of community members like Getty Hill, who first suggested enhancing the protocol’s fee collection mechanism.

The post Uniswap Governance Proposal Sparks 60% Price Surge appeared first on BeInCrypto.