Crypto Forecast: Top Picks For This Week’s Portfolio

In a week bustling with pivotal developments across the crypto industry, investors have their eyes set on several key events and updates poised to influence market dynamics. From the anticipation surrounding Ethereum’s annual conference to Nvidia’s earnings report potentially impacting AI-related tokens, the landscape is rife with opportunities and uncertainties. Here’s an in-depth look at what to watch in the crypto space this week.

#1 Ethereum: Gearing Up For ETHDenver And More

Ethereum remains at the forefront of investors’ minds as ETHDenver 2024 approaches. Scheduled from February 23 to March 3, this significant gathering is expected to catalyze a series of project announcements that could steer Ethereum’s trajectory.

Furthermore, the impending Dencun upgrade, merely 23 days away, alongside the speculative anticipation of spot Ethereum ETF approvals in May, presents a potentially transformative phase for Ethereum. Notably, the spot ETH ETF approvals don’t seem priced in, holding at a latent upside potential for Ethereum’s valuation.

Renowned crypto analyst Miles Deutscher commented on X: “ETH/BTC continues to grind higher, and I think at some point we see an aggressive candle to the upside. The first set of ETF decision dates are in May.”

#2 AI Coins: Nvidia’s Earnings Report As A Catalyst

The imminent release of Nvidia’s Q4 2023 earnings on February 21 has the crypto community on edge, especially those vested in AI-related cryptocurrencies. With Nvidia’s stock surging 45% since their last report, adding a staggering $600 billion in market cap, the question remains: Can Nvidia sustain its historic run?

The outcome of this report is crucial for AI-tied tokens such as FET, GRT, INJ, RNDR, and AGIX, as Nvidia’s performance is a barometer for investor sentiment in the AI and crypto domains. Positive earnings could invigorate the sector, driving up interest and investment in AI-focused cryptocurrencies.

#3 Polygon (MATIC): Launch Of AggLayer V1 Mainnet

Polygon is set to unveil its Aggregation Layer (AggLayer) on February 23, marking a significant step towards enhancing interoperability and user experience across blockchain ecosystems. By leveraging zero-knowledge proofs, AggLayer aims to streamline liquidity and enable seamless cross-chain transactions.

This development is a cornerstone of Polygon 2.0, signaling a departure from traditional interoperability solutions and potentially bolstering Polygon’s position in the market. A successful launch could propel MATIC’s price.

Deutscher remarked on MATIC: “I touched on this last week, but MATIC is rumored to be rebranding soon, in the midst of many ZK improvements/implementations. Compared to other chains, Polygon is starting to represent decent value, and the BTC pair also looks bottomed.”

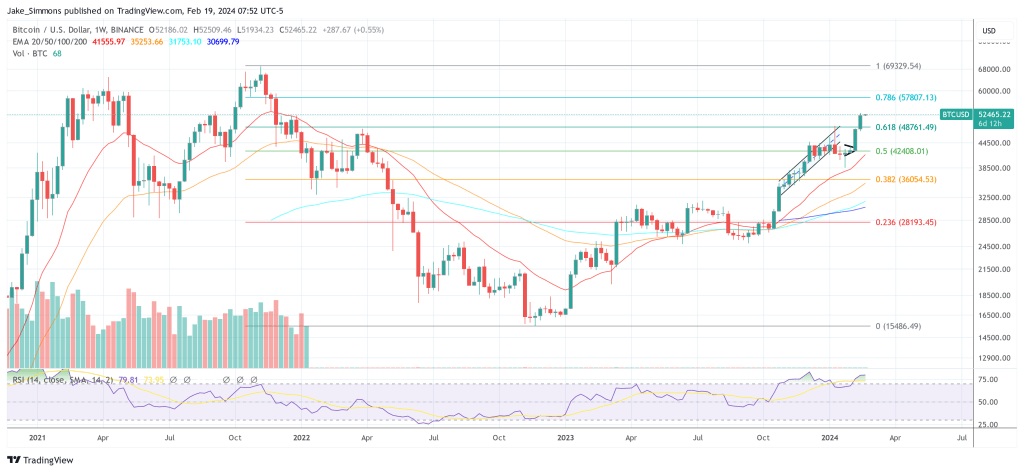

#4 Bitcoin: Market Sentiment And FOMC Minutes

The number 1 cryptocurrency, Bitcoin, will once again be the beacon for the entire market. While today, Monday, the traditional finance markets are closed due to a holiday (Presidents Day) in the US, which means that spot Bitcoin ETFs cannot generate any new demand for the time being, all eyes will be back on the ETF inflows this week.

The big question is if the massive demand will continue. Last week, $2.2 billion flowed into these ETFs.

Furthermore, the upcoming release of the FOMC minutes is anticipated to shed light on the US Federal Reserve’s interest rate policies. With inflation not decelerating as expected, the Fed’s stance could significantly sway market sentiment, impacting Bitcoin and the broader crypto market. At press time, BTC traded at $52,465.

#5 Starknet (STRK) Airdrop: A Crypto Token Launch With High Expectations

The crypto community is also poised to see another major airdrop this week. The StarkNet Token (STRK) airdrop will occur on Tuesday, February 20, 2024, at 12 pm UTC.

With the token’s over-the-counter (OTC) trading valuation soaring to an impressive $18 billion, expectations are sky-high for this launch. The airdrop aims to distribute 7% of STRK’s total supply, marking a crucial step for StarkNet in engaging and rewarding its community.

Let us intro:

The Starknet Provisions Program

Claiming starts Feb 20, 2024, 12pm UTC

Check your eligibility 👇https://t.co/jcQQuD8uOX pic.twitter.com/rAMSSzTu5p

— Starknet Foundation (@StarknetFndn) February 14, 2024

Featured image created with DALLE, chart from TradingView.com