Weekly Crypto Preview: Top 3 Altcoins You Shouldn’t Miss

Several key developments across various altcoin projects are poised to potentially influence this week’s crypto market dynamics. This week’s focus is on Ripple (XRP), Polygon (MATIC), and Avalanche (AVAX) in conjunction with its associated GameFi project, Shrapnel (SHRAP).

#1 XRP: Ripple Awaits Crucial Legal Developments

As February 12 looms, the XRP community is keenly anticipating the next developments in the ongoing Ripple-SEC lawsuit. This date marks the deadline for the remedies-related discovery phase, necessitating a ruling from Judge Torres on the SEC’s motion to compel.

The motion, filed on January 11, seeks Ripple’s financial statements for 2022 and 2023 and details of post-Complaint contracts with institutions. Ripple’s January 19 response argued that disclosing these contracts could lead to unnecessary legal scrutiny of their post-complaint institutional sales.

The SEC, in its January 23 reply, downplayed the potential for a mini-trial and noted that Ripple had already cataloged post-complaint sales contracts up to June 2023 in a separate legal matter (Zakinov vs. Ripple). Ripple countered this, claiming the SEC’s statement about cataloging and production was misleading.

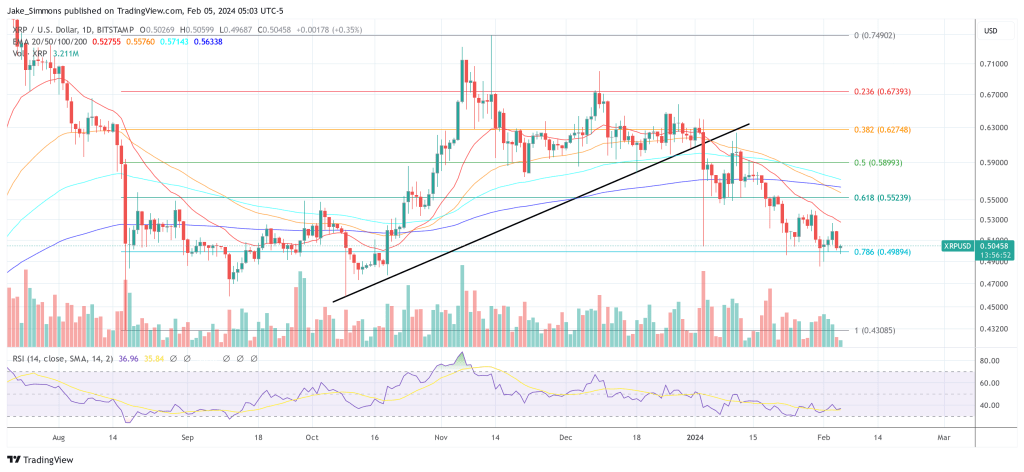

These unfolding legal dynamics could significantly influence XRP’s market performance in the coming week. At press time, XRP was hovering just above the crucial support at $0.4989 (0.786 Fibonacci retracement level).

#2 Polygon (MATIC) Prepares For The Etrog Upgrade

Polygon is on the brink of an important upgrade, transitioning its zkEVM to a Type 2 ZK-EVM. Scheduled for February 6, the Etrog upgrade, currently live for testing on the new Sepolia-anchored Cardona testnet, promises enhanced compatibility and efficiency for crypto developers and users alike.

This upgrade will allow developers to deploy their code on the Polygon zkEVM exactly as it is on Ethereum. Moreover, it will introduce five additional pre-compiled smart contracts, improving EVM-equivalence and facilitating the deployment of existing dApps without modification.

It also restructures the processing of transaction batches for increased network efficiency. Notably, the Etrog upgrade follows Polygon’s governance model, which includes a 10-day timelock period. This allows users to verify the upgrade and withdraw their crypto funds if they so choose. The timelock has been triggered on January 27 and concludes on February 6.

The next upgrade for Polygon zkEVM will, effectively, make the network a Type 2 ZK-EVM. What does that mean for developers? It means that you can deploy your code on Polygon zkEVM exactly as it is on Ethereum—just copy-paste and go, no modifications necessary.

The 10-day… pic.twitter.com/GThNxj7V6F

— Polygon Foundation (@0xPolygonFdn) January 27, 2024

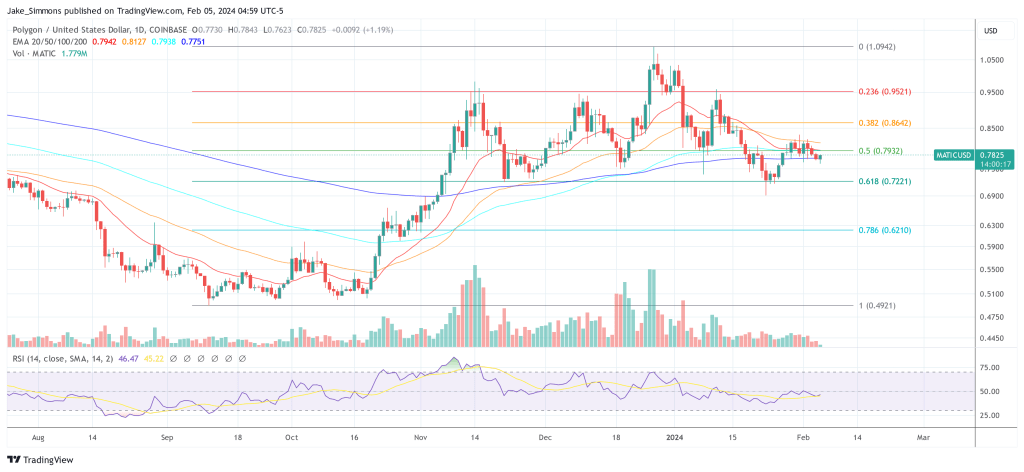

At press time, MATIC was trading at $0.7825, just above the 200-day EMA. If this support holds, the resistance at $0.7932 (Fibonacci retracement level) could be the next target.

#3 Avalanche (AVAX) / Shrapnel (SHRAP) Gear Up For Crypto GameFi Launch

Avalanche’s highly anticipated GameFi project, Shrapnel, developed by Neon Machine (an HBO Interactive spin-off), is set to begin early access on February 8. This blockchain-based shooter game has already garnered much attention in the crypto space with a successful $7 million token sale, attracting investments from prominent entities such as Dragonfly, Three Arrows Capital, and notable angel investors.

Shrapnel introduces an engaging gameplay concept where players, as mercenaries, vie for a resource known as compound sigma. The game’s economy leverages NFTs, allowing players to create, mint, and trade game items and maps. Additionally, the SHRAP token plays a central role in the game’s governance, staking, and transactional aspects.

📢 STX1 – Launch alert!

WEN? Our first STX event (STX1) begins on Feb 8th and concludes on Feb 10th.

🏆Gear up for an intense competition with an STX1 prize pool of US$100,000 in SHRAP thanks to @RNGFoundation – extract Sigma, and dominate the leaderboard!

🎖️Unlock exclusive… pic.twitter.com/0vLgR0onjN

— SHRAPNEL 🔺 (@playSHRAPNEL) January 29, 2024

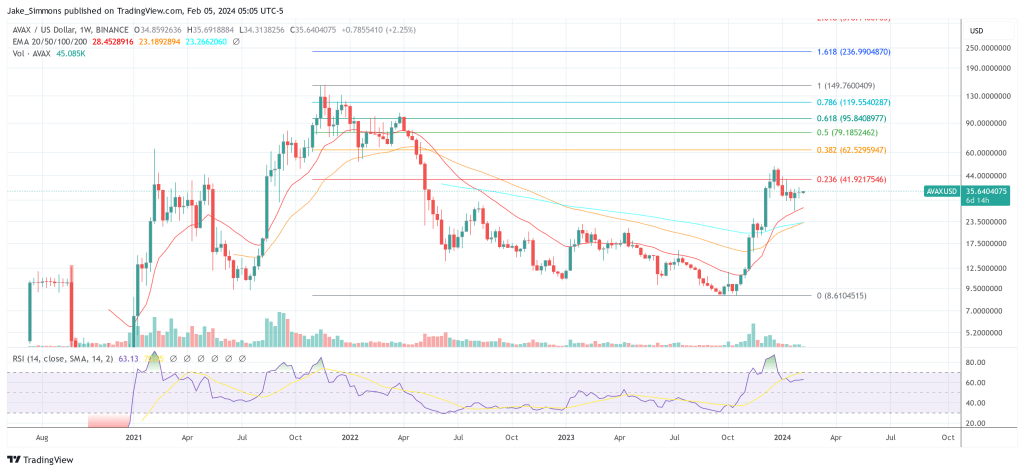

While still in its nascent stages, Shrapnel’s unique integration of gaming and blockchain technology could impact both SHRAP and AVAX prices in anticipation of its launch. In recent weeks, AVAX has gone through a consolidation phase after a strong rally. Now, the AVAX price is aiming for a break above the 0.236 Fib at $41.92.

Featured image created with DALL·E, chart from TradingView.com